* We make every effort to ensure that we accurately represent these products and services and their potential for income. Earning and/or income statements made by our Company and/or Independent Representatives are estimates of what you can possibly earn. There is no guarantee that you will make these levels of income and you accept the risk that the earnings and income statements differ by individual. The examples are not to be interpreted as any guarantee, promise, representation and/or assurance. We do not purport our business and/or us as being a 'get rich scheme. As with any training, your results may vary, and will be based on your individual capacity, business experience, expertise, and level of desire. There are no guarantees, promises, representations and/or assurances concerning the level of success you may experience. Your level of success in attaining the results claimed depends on the time you devote to the course, your job search, the ideas and techniques mentioned, knowledge and various skills, since such skills and factors differ according to individuals.

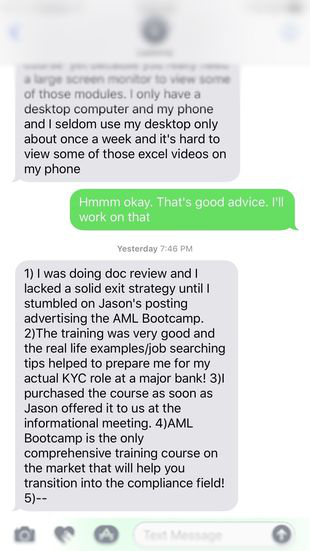

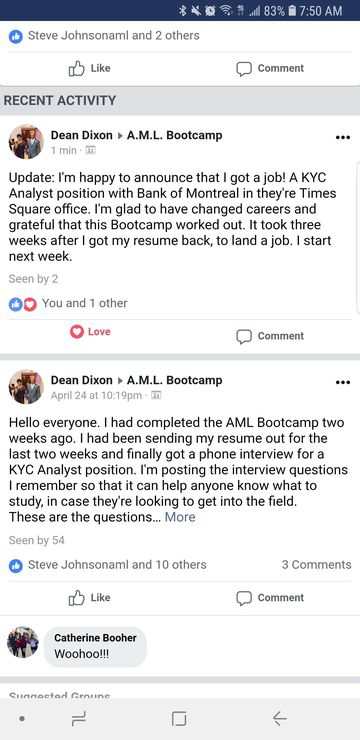

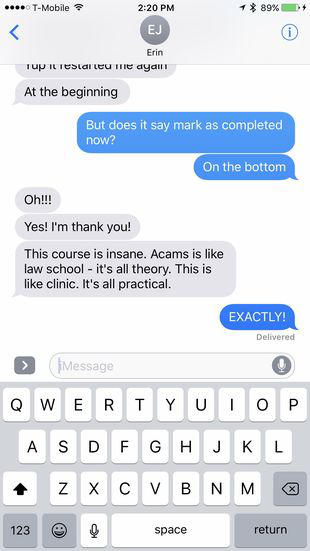

Testimonials and examples used are exceptional results, which do not, or may not, apply to the average person, and are not intended to guarantee, promise, represent and/or assure that anyone will achieve the same or similar results. We reiterate that each individual’s success depends on his or her background, dedication, desire and motivation.There is no assurance that examples of past earnings can be duplicated in the future. We cannot guarantee your future results and/or success. There are some unknown risks in business and on the Internet that we cannot foresee, which can reduce results. We are not responsible for your actions. Any claims made of actual earnings or examples of actual results can be verified upon request.The use of our information, products and/or services should be based on your own due diligence, which you undertake and confirm that you have carried out to your entire satisfaction. You agree that our company is not liable for any success or failure of your business, career, acts and/or conduct that is directly or indirectly related to the business and/or the purchase and use of our information, products and/or services.